estate tax exemption 2022 inflation adjustment

Then the gift and estate tax exemption is lowered. Committed to Delivering High-Quality Estate and Trust Planning in a Fast and Effective Way.

Irs Provides Tax Inflation Adjustments For Tax Year 2022 Income Tax United States

The official estate and gift tax exemption climbs to 1206 million per individual for 2022 deaths up from 117 million in 2021 according to new Internal Revenue Service.

. Lower Estate Tax Exemption. For 2022 basic deferral amounts for employer provided 401 k 403 b and many 457 plans will increase to 20500. From Fisher Investments 40 years managing money and helping thousands of families.

In 2022 the federal estate tax exemption is 12060000 for an individual or 24120000 million for a married couple. The federal gift estate and GST tax exemption amount. The basic exclusion amount for.

Ad Take out the guesswork with The Investors Guide to Estate Planning for 500k portfolios. Ad Estate Trust Tax Services. If you have an.

As you contemplate your estate planning or making gifts during the new year here are the numbers that were published for 2022. As of January 1 2022 that will be cut in half. Transfer tax exemption for lifetime gifts death transfers and generation-skipping transfers.

Learn How EY Can Help. Inflation Is Quietly Raising Middle Class Tax Bills Through Bracket Creep. The amount is adjusted each year for inflation so thats not a surprise.

The annual exclusion amount for gifts made to a noncitizen spouse in 2022 increases to 164000 from 159000. Currently the allowed estate and gift threshold is 10000000 adjusted for inflation. The alternative minimum tax exemption for estates and trusts will be 26500 was 25700 and the phaseout of the exemption will start at 88300 was 85650.

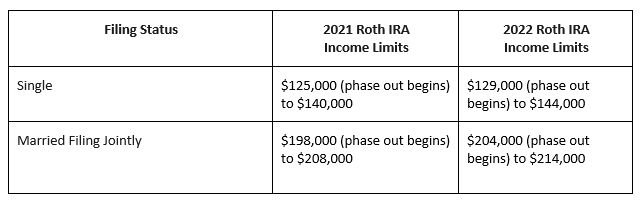

2022 Annual Adjustments for Tax Provisions. The IRS has announced the 2022 inflation adjustments for many tax provisions including exemptions for estate gift and generation-skipping transfer taxes and the annual. The maximum credit amount for qualifying adoption expenses increased to 14890 up from 14440 in the previous year.

Estates of decedents who die during 2022 have a basic exclusion amount of 12060000 up from a total of 11700000 for estates of decedents who died in 2021. The basic exclusion amount for estates of decedents who die during 2022 is 12060000 up from 11700000 for estates of decedents who died in. November 10 2021.

2022 Annual Adjustments for Tax Provisions. The Internal Revenue Service has released Rev. The annual inflation adjustment for.

Estate and gift exclusions. Following our September posting of a preview of the 2022 estate tax exemptions the IRS recently released the inflation-adjusted amounts that will apply in 2022. Washington DC reduced its estate tax exemption amount to 4 million in 2021 but then adjusted that amount for inflation beginning.

Estate tax exemption 2022 inflation adjustment. Federal Estate Tax Exemption. Ad Estate Trust Tax Services.

The Technical Analysis Patterns Cheat Sheet Is A Meta. On November 10 2021 the IRS announced that the 2022 transfer tax exemption amount is 12060000 10000000 base amount plus an inflation adjustment of 2060000. 2022 Exemptions and Exclusions.

Committed to Delivering High-Quality Estate and Trust Planning in a Fast and Effective Way. Under President Obama the credit was set at 5 million per person adjusted for inflation. At the federal level the estate tax is referred to as a unified credit meaning that the exclusion amount is the total amount excluded from taxes.

The federal estate tax exemption is going up again for 2022. 2021-45 with inflation adjustments for 2022 and consistent with earlier predictions the changes in the most. The annual inflation adjustment for federal gifts inheritance and generation-skipping tax exemption has increased from 117 million in 2021 to 1206 million in 2022.

The federal estate tax exemption for 2022 is 1206 million. The 1 million estate tax exemption hasnt been adjusted for inflation since 2006 so it can hit the heirs of middle-class folks who have seen their houses and retirement. For taxpayers age 50 years and older the additional.

Learn How EY Can Help. Under President Trump the credit was set at 11 million per person adjusted for. The estate tax exemption is adjusted for inflation every year.

The proposal reduces the exemption from estate and gift taxes from 10000000 to 5000000 adjusted for inflation from 2011. Other states with 2022 changes. The Internal Revenue Service recently announced its annual inflation adjustments for tax year 2022 and many tax provisions have increased as a result.

Irs Releases Annual Inflation Adjustments For Tax Year 2022 Choate Hall Stewart Llp

2022 Iowa Tax Brackets New 2026 Iowa Flat Tax 0 Retirement Tax

Estate Tax Exemptions 2022 Fafinski Mark Johnson P A

Irs Provides Tax Inflation Adjustments For Tax Year 2022 Income Tax United States

Irs Tax Brackets 2022 What Are The Capital Gains Tax Rate Thresholds In 2021 Capital Gains Tax Tax Brackets Irs Taxes

Irs Announces 2022 Tax Rates Standard Deduction Amounts And More

Irs Announces 2022 Tax Rates Standard Deduction Amounts And More

2021 And 2020 Inflation Adjusted Tax Rates And Income Brackets

Don T Forget To Factor 2022 Cost Of Living Adjustments Into Your Year End Tax Planning Miller Kaplan

Inflation Updates For 2022 Federal Estate And Gift Tax

Irs Provides Tax Inflation Adjustments For Tax Year 2022 The Duffey Law Firm

New Income Tax Rules From April 1 2022 7 Major Changes To Kick In From Today

Inflation Pushes Income Tax Brackets Higher For 2022

Irs Provides Tax Inflation Adjustments For Tax Year 2022 The Duffey Law Firm

Make Note Of These Estate And Gift Tax Exemption Amounts For 2022 Preservation Family Wealth Protection Planning

Irs Announces 2022 Tax Rates Standard Deduction Amounts And More

Don T Forget To Factor 2022 Cost Of Living Adjustments Into Your Year End Tax Planning Jones Roth Cpas Business Advisors

Income Tax Brackets 2022 Which Are The New Tax Figures And Changes You Need To Know Marca